Weekly Update: New Subscriber Addition

More Big Profits Booked

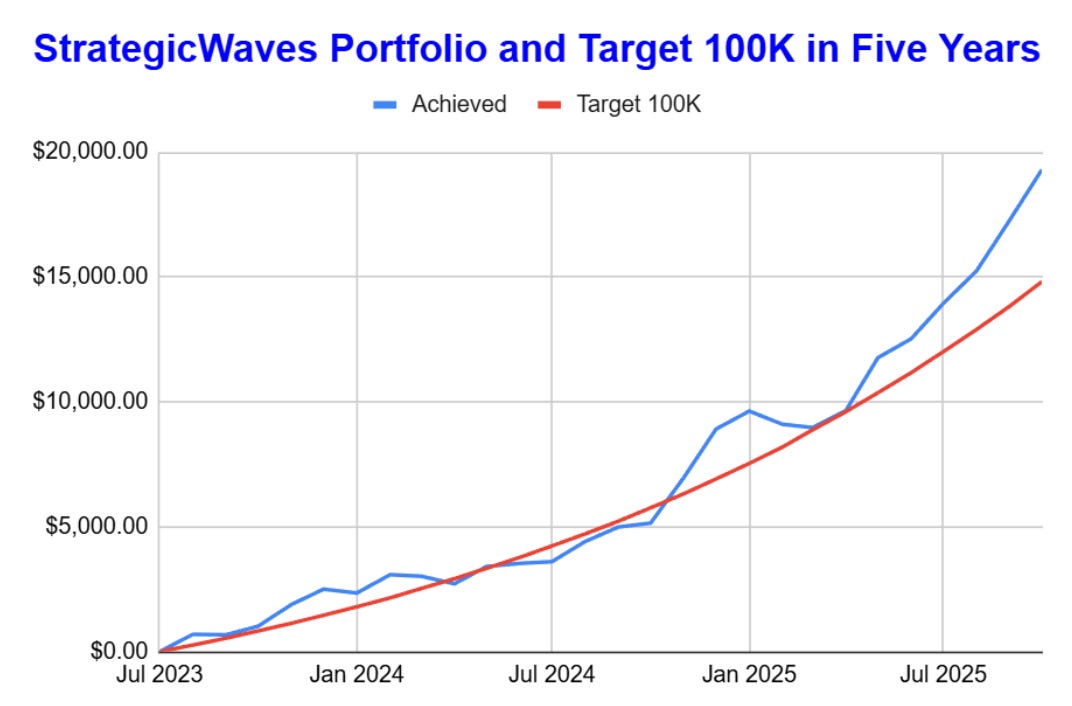

New and potential subscribers often ask what the best way is to make use of the newsletter and how they can join the $250 to $100,000 project when it is now in its third year. I will look into some options this week, but first, let’s look at last week’s performance.

More Volatility and more Profits Booked.

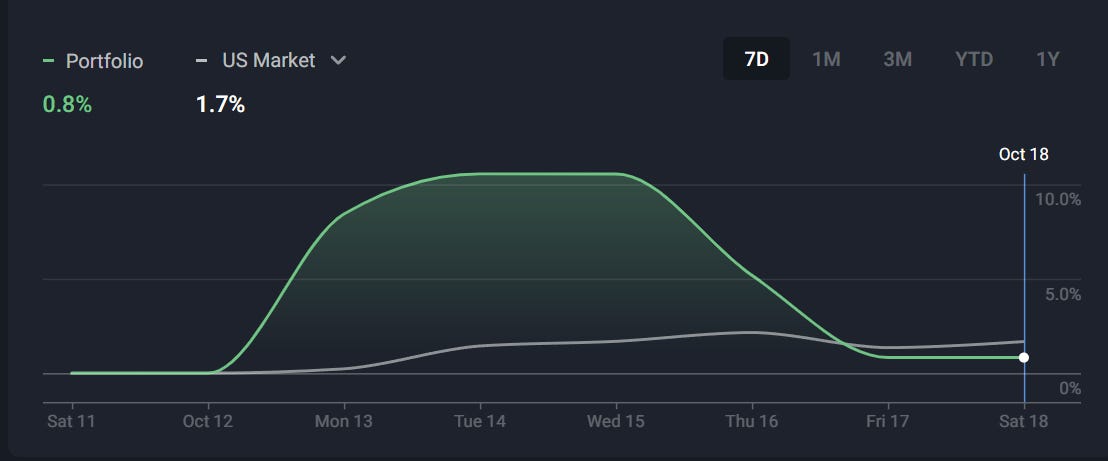

Extreme volatility is becoming a watchword for 2025, this week we saw an all time high on the account before it fell back sharply on Thursday and Friday giving up all of its gains finishing the week almost unchanged showing an 0.8% return, the US markets advanced 1.7%. The chart shows the wild swing from last week.

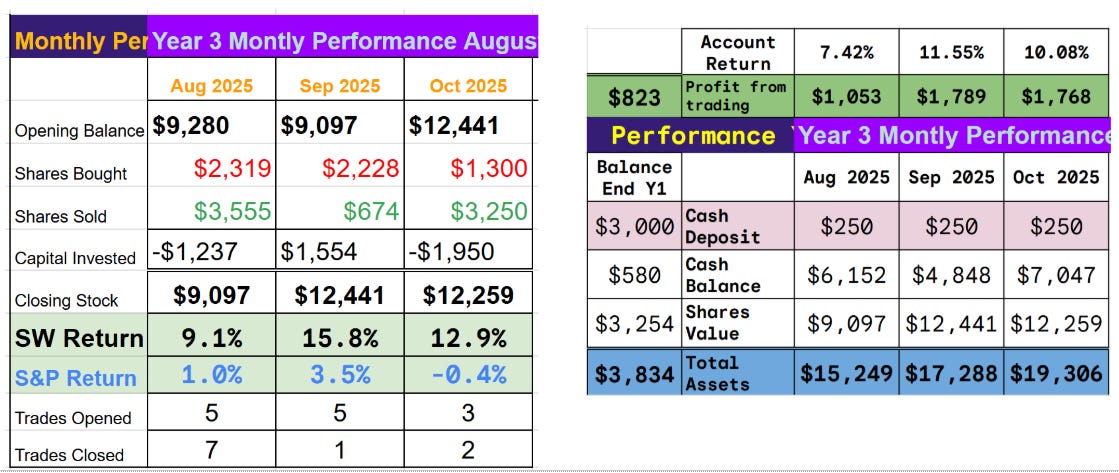

The US Stock trading account Key Balances

(Active since August 1st, 2023 deposit $250 a month.)

Trading Activity

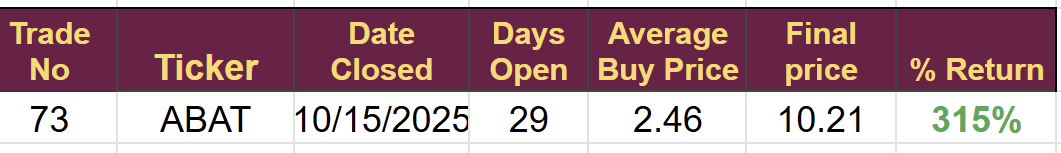

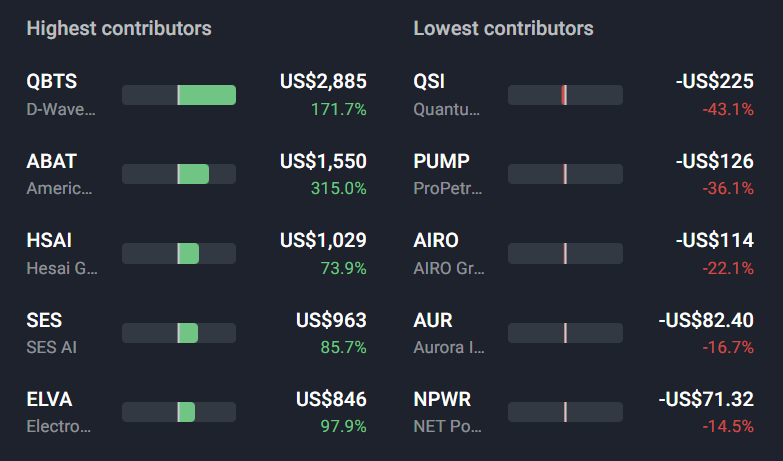

We booked a big profit closing ABAT just before the big sell-off and managed to maximize our return. It is the second week in a row we have booked a triple-digit percentage gain.

ABAT jumped to second place on our list of best-performing assets.

We opened one new trade during the week, which is currently showing a small loss of 3%.

The account as a whole remains above target; we need a compound average return of 5.2% per month to reach the target, and October is currently showing 10%.

The account did pass $20K for the first time during the week, but has since fallen back

Fear in the Market

Concerns about another credit crunch, this time coming from the private credit market, led to a deep sense of nervousness. The failures of First Brands and Tricolor highlight the expanding, less-regulated private credit market, now valued at $3 trillion and projected to reach $4.5 trillion by 2030. Unlike banks, private credit firms, funded by private investors, face fewer capital requirements and less scrutiny, enabling faster, riskier loans. They were formed to circumvent the rules placed on banks to avoid a repeat of the last crisis, but money is like water; it flows downhill and is very hard to stop. This lack of oversight raises concerns about lending standards, especially as traditional banks are increasingly exposed to these firms. JPMorgan recently reported a $170 million loss from Tricolor, and Jeffries reported a $700 million exposure to First brands. The concern is always of a knock-on effect: a financial entity somewhere in the market faces a crisis caused by the failure of one of these private credit firms. This, in turn, leads to a crisis higher up the food chain, resulting in another full-blown credit crunch.

The risks seem low at the moment, but they have spooked the markets a little, so we will need to be very vigilant in the coming weeks and months.

How to Make the Most of the Service

The newsletter has an active chat area where subscribers share their individual trading plans and styles. Some take every trade alert, entering and exiting when I do, while others pick and choose the trades they will take and when to exit

During the week, Alan shared some of the results of his strategy of closing only part of the trade when I close all of mine, he posted

“SES up 262% in total, up 22% since your close. Qbts up 2365% in total, up 74% since last close…... Onds up 410% in total, 91% since close. Joby up 177% in total, 6% since close, Npwr still down 15% in total but coming back, Leu up 967% in total, not sure when you exited, Genius up 74% in total, again not sure when exited”

Alan is one of many making good money using the trade alerts to boost his performance, as an experienced trader, he makes excellent decisions in line with his own targets and financial circumstances.

Many new subscribers could start by following this kind of plan, reading the trade alerts and making decisions about how they proceed, the trade alerts contain quite a lot of information about competitive players in each sector and several new subscribers use that info to take additional trades.

Following the $250 to $100,000 plan

This project attracts a lot of interest, much of it skeptical, but as time passes, most people are realising it is a real possibility. We are now 27 months into the five-year plan. The halfway point will be December 31st, and we are well above target.

The question is, how do you start if we are already in year 3 of 5?

Probably the most important part of the project is position size and having enough money in the account to take the trades when they arrive. (I covered position size and number of trades in some detail last week)

The first year of the project was not as successful as the second because of the position size. I started investing $250 per trade, which is equal to a month’s deposit, but I did not have the money to take many trades. It was a big hindrance and, in hindsight, was not the ideal plan.

As time has progressed, I have built a cash balance from profits taken, allowing me to take more trades each month with an increased position size.

A Better Way To Start

I keep meticulous records of every trade taken on my spreadsheets and often go back to look for better plans and strategies. In this case, I looked at scenarios that would have improved performance using different position sizes and deposit amounts.

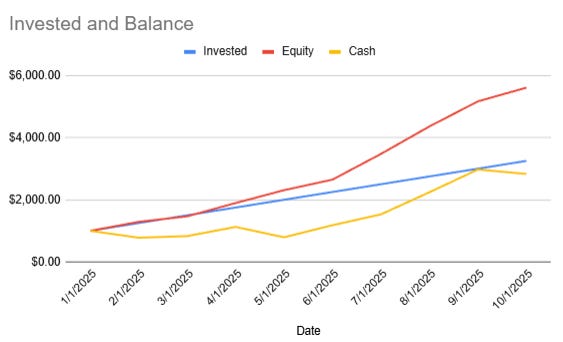

I imagined a scenario where I started following the plan on January 1st, 2025, and would take every trade taken.

I chose the start date for several reasons. The number of trades taken seems to have stabilized from mid-2024. In early 2024, I was still constrained by available funds, but I didn’t want to include the big 600% QBTS win in October 2024, as it would skew the results.

I ran numerous scenarios for position size and deposit amounts, using only the trades actually taken and the fill prices received.

The best plan was to invest $1,000 on January 1st and $250 on the first of each subsequent month. The initial investment could be split over two months, but without the additional $750, the account might run out of cash.

The ideal position size was $100; any more and the cash balance went negative, any less and returns were not good enough.

The results of applying this strategy are shown in the graph.

The total return of 78% is far better than the first year of the actual returns on the account, which was below target 40%.

Of course, I cannot guarantee the performance from 2025 going forward. Money management is one side of the coin, but choosing high-return companies is the other side. We have had a fantastic three years, but the past is no guarantee of future performance, and anyone investing in these small-cap, early-stage companies should recognize the high-risk nature of this part of the investing world.

Conclusion

New Subscribers have to decide how to make the most of the trade alerts; they could look back through past trades and take the ones they like. They might consider future alerts and invest an amount of money that suits their circumstances and must make decisions about when to exit. I exit the complete position but many subscribers chose to close part of the position and let the rest run.

The $250 to $100,000 requires the recycling of cash and a doubling of position size each year and having the cash to take enough positions.

An improved version of the plan would be to begin with an investment of $1,000 in month 1 and then add $250 each month thereafter. When applied to the trading results of 2025, this plan showed a good return, enabling all trades to be taken and the cash balance to double within the year, allowing for an increase in position size.

Following this plan would have led to a profit of $2,357 by the first of October and the total investment would have been $3,000, a 78% return. The cash balance would have been $2,829 (after the October $250), allowing position size to double to $200.