Weekly Update: Forward Testing Is The Only Way

New Trade Imminent

The portfolio suffered some wild swings in October, from the high point on the 14th, it fell 17% by the close of markets on the 22nd. Over the same period, the S&P 500 swung about 1%. This is to be expected, and I covered in some detail why it did not make sense to trim during this downturn. Volatility is what we seek; of course, we don’t like it when things go down, but without outsized moves, we will never deliver outsized returns.

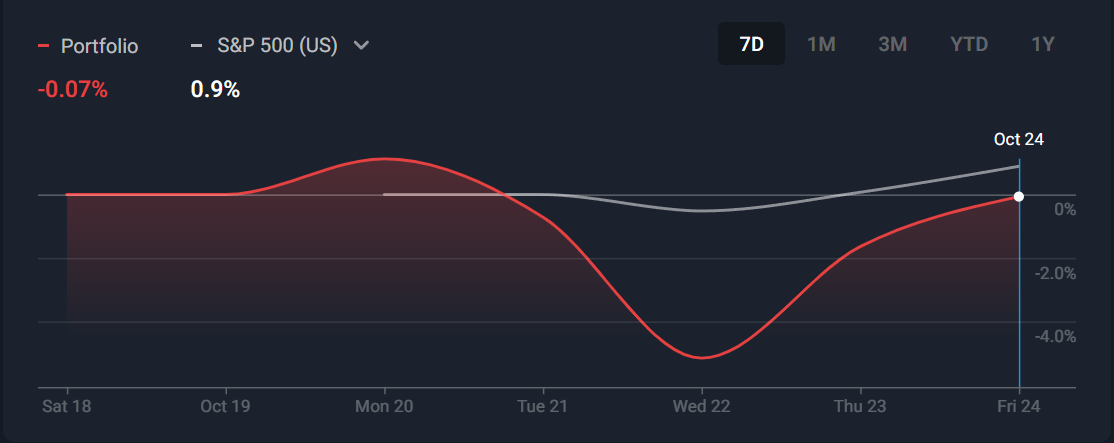

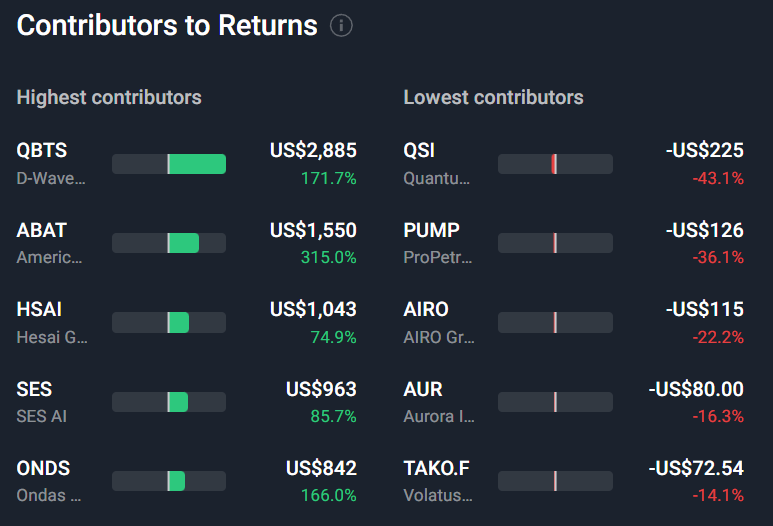

This chart of last week's performance shows the market crazes that affected us; we ended up almost unchanged but lagged the S&P.

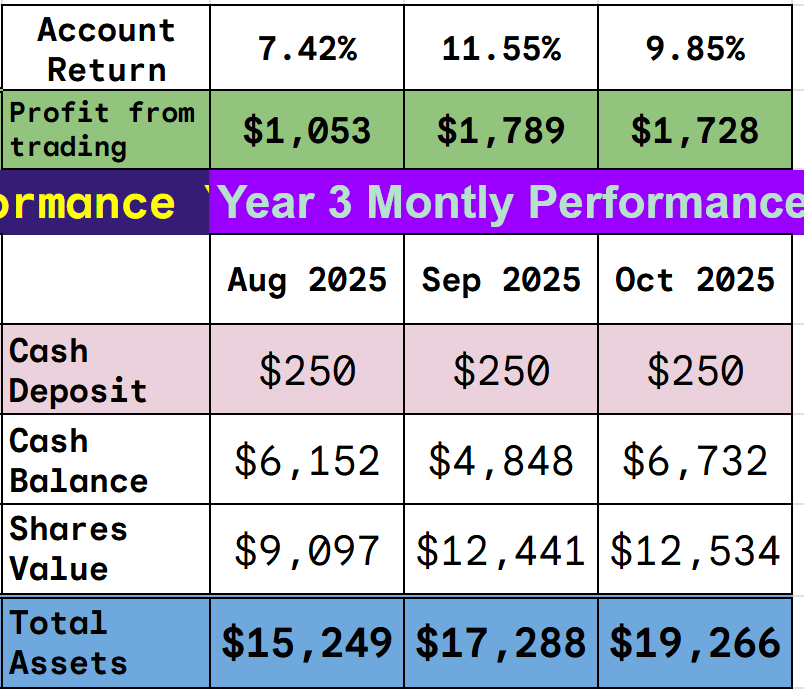

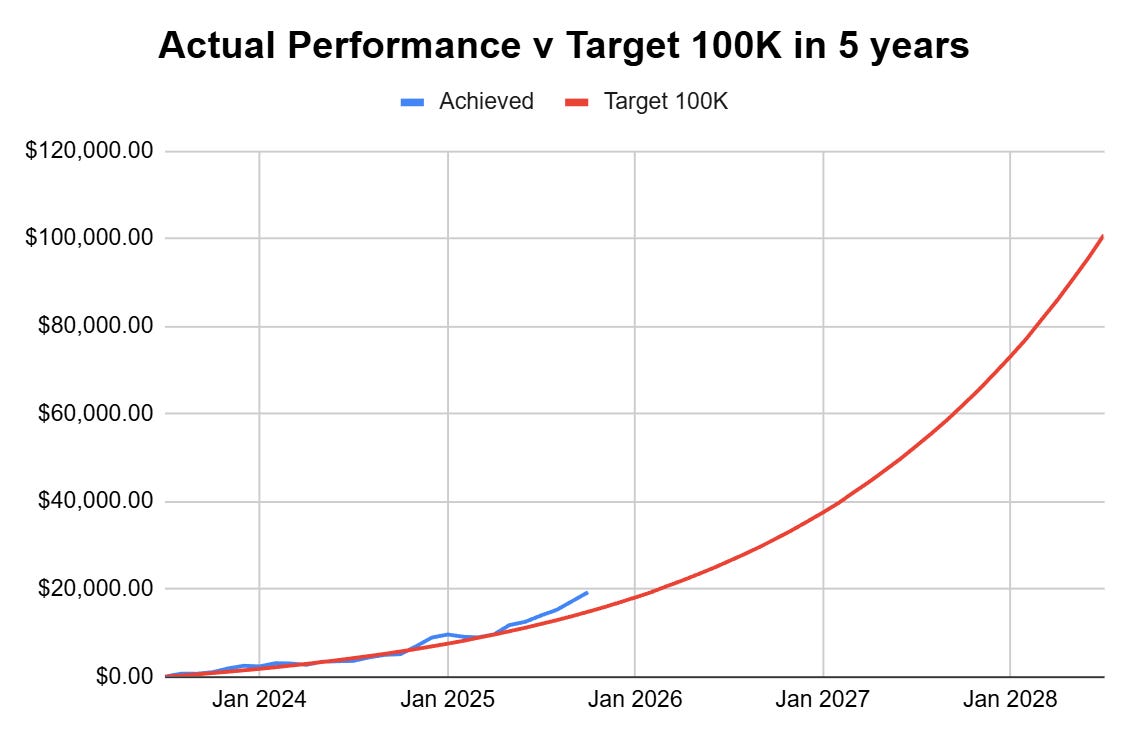

We must look past short-term market gyrations and focus on the plan and the targets. The plan continues to deliver above target performance.

It is the top row that matters, as long as the average stays above 5.2% we will hit the $100,000 target in five years.

You can see from the following chart that we have a long way to go in dollars, but Jan 2026 is the halfway point, and we have already made the profit expected at that point.

The UK Margin Account

This experimental account held with IG Markets has suffered hugely in the last few weeks. Two weeks ago, I talked about a large loss the account suffered and said, “I generally do not panic sell, but it might be better to have done so on the margin account.”

The original plan was to take the same trades at the same time as the stock trading account and use margin to boost returns.

Two of the Three elements of the plan have failed.

Far too many stocks are unavailable on this platform, and some of the biggest winners on the stock trading account have been absent from the margin account. I cannot trade the same stocks.

The sharp pullbacks have a much bigger impact on the margin account, and on Wednesday, I started running into margin trouble, forcing the closure of multiple positions.

I cannot trade in the same way.

Margin is definitely boosting returns, but in both directions.

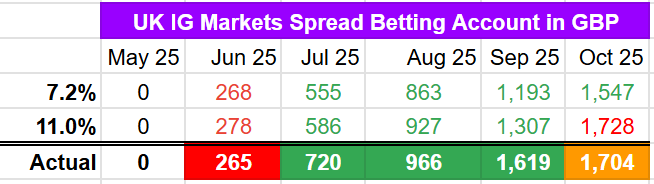

Despite an 8% loss in October, the compound returns over time are good. The account opened with an initial monthly deposit of £250 on June 1st.

The account remains above the 7.2% monthly compound return target. It is only just below the 11.0% one (if you remember, these two percentages will turn £250 a month into £100,000 in 48 and 36 months respectively, with the added benefit that this is tax-free in the UK).

Bearing all of this in mind, I think a minor adjustment is required.

The problems all stem from the margin; if a stock falls 15% in the stock trading account, it is a minor concern, and I might start looking at what is going on. On the margin account, it wipes out my available funds, triggering a margin call that forces me to close the trade at a loss.

I have been back through every trade, and one pattern stands out:

Positions opened when Stochastics were below 20 survived the recent pullbacks without a margin call, whereas those opened above 20 did not. This is true of both initial positions and subsequent additions.

Why I have Stochastics on My Charts

About 20 years ago, I was working at one of the best mathematics schools in Asia. It was a fantastic job, and I got to work with some of the best mathematicians in the world, coaching students for the International Mathematical Olympiads.

In the evenings, I started a project to find a technical solution to the markets. Using an excellent backtesting platform provided by FXCM, which was at the time the world’s largest broker, I tested every combination of the 120 technical indicators they offered on every time frame from 5 minutes to 1 week on every asset class FXCM had (all the forex pairs, all the indices, all the commodities and about 2,000 individual stocks). FXCM provided 30 years of data, and astonishingly, the entire package was free to use.

The research was a crucial step towards developing my current trading plan, as it confirmed that there is no technical solution to the markets. Anyone claiming they have such an algorithm is manipulating the truth and cherry-picking results. (although younger investors, yet to trade through the whole variety of markets may not realize it)

None of the indicator combinations provided a profit across assets and timeframes.

The research had one caveat: If you applied the indicators only to periods when the asset class was in a bull market and only allowed buy signals, then multiple indicators would have made a profit over the length of the bull run. (This worked in reverse during a bear market.) The result of the work was to prove that if you buy stocks that go up in value, you make money (somewhat obvious), but technicals cannot help you choose them.

If my fundamental work is correct, I should only trade a stock that is either in or about to enter a bull run, and consequently, technicals should help.

I will change the plan for the Margin account by adding a single extra rule:

Only buy when Stochastics are below 20

Back in 2010, when I completed the technical work and wrote up the conclusions (it took four years to complete the study), Stochastics (20,5,5) was the best simple rule. I classified simple rules as those with less than 5 indicators, there were more effective combinations but the added complexity of 37 indicators outweighs the incremental gain.

The new rule will further reduce the number of assets I can trade, many entry points will be delayed and some of our most profitable trades will never be taken. But the margin problems and consequent losses suffered will hopefully be avoided. I have not been able to identify an improved exit rule or a way to mitigate the number of trades I will not be able to take, and I will be working on that over November.

I have backtested the new rule on the US stock account, and it significantly reduced overall profits due to missed trades; four of the top five returns would have been missed, and I would still have taken the bottom five. (Most of these were not available on the margin account).

So no change to the US Stock Trading Account

Outlook for next week

I think it will be a busy trading week. I hope to add one new name to the portfolio, and several of our current holdings have set off trade alarms, as have multiple previous trades.

The new name looks like a clear multibagger opportunity.

I will be going through each trade alarm to see if any of them have the fundamental background to warrant a new trade.

It is all about the fundamentals; the technical trade alarms get me to look, but they do not get me to buy. I have already proven to myself that technicals alone cannot provide alpha without a fundamental justification.