Weekly Update: Emerging Company Volatility

Little change overall

The first week of September brought a lot of news for us to digest, with companies in our portfolio announcing funding rounds, dual listings, and a spin-off. A comprehensive news digest is included in the paid section of this newsletter.

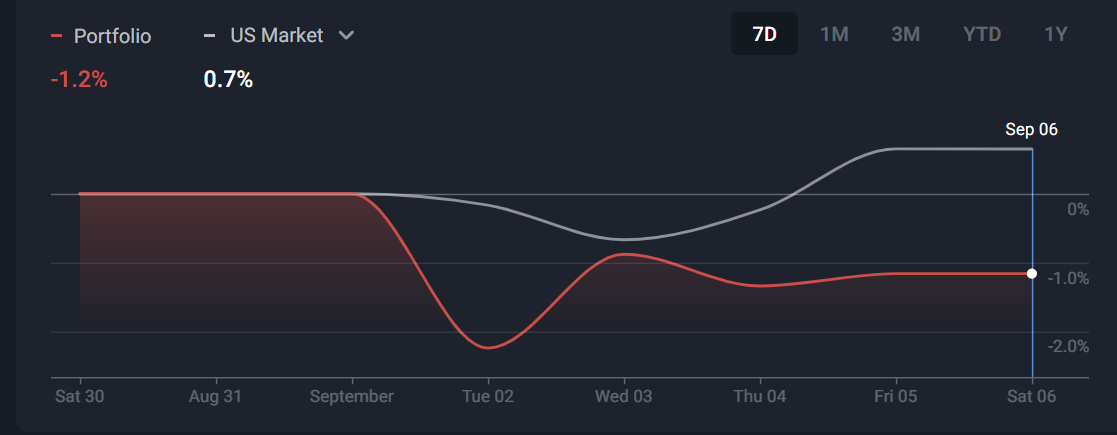

The portfolio underperformed the markets last week, registering a small loss, whereas the S&P ended in positive territory.

The two trades taken in the week dropped by almost 5% and 16%, respectively. Unfortunately, it is not uncommon in our small-cap emerging technology universe. The loss was offset by some significant appreciation in our two largest holdings ELVA and HSAI (7% and 6% respectively).

So far, we have not delivered 6 consecutive monthly gains in the 25 months the project has been going; September could be the first time.

In total, we have had 8 losing months and 17 winning ones on our way to a total return of 432%.

The project to trade $250 into $100K remains above target and is now in month 26.

The spread of our investments among the emerging technologies we follow is shown below.

I want to increase exposure to Drones and Space, and am actively analysing companies with good risk-reward profiles.

I expect to add a New Materials company this month.

I am currently analysing several stocks with a view to increasing the size of our positions.

The sectors I track without any current trades are: hydrogen, charging, RF manufacture, recycling, agriculture, 3D printing, robots, healthcare, and environmental.

I have recently reviewed hydrogen and robots. I was able to add some companies to the “eyes on” list, but did not identify a good risk-reward opportunity.

I do not expect to make any trades in the early part of next week aside from some add-on activity.