Adjusting the portfolio

I have been discussing the need to adjust the portfolio balance since January, and it will be an ongoing process. In the coming days, I expect to make several changes, reducing the size of some holdings, perhaps even closing some, and increasing the size of others to take advantage of fallen stocks. I want to ensure we are well positioned to make ongoing outsize returns.

The US administration

The current US government is significantly impacting the companies I'm watching. For now, I will want to reduce my exposure to any company that derives a substantial amount of its revenue from the government, regardless of whether it is orders or grants. I have several concerns, the first is the administration's aim to cut government spending, which will inevitably lead to lower awards in the future, secondly, the large-scale reduction in the workforce. The workforce changes will inevitably disrupt the short-term performance of these government departments as they develop new working practices. The effect on morale must be pretty damaging, which will make the new structures take longer to build.

This affects my view of:

LUNR: Intuitive Machines rely on NASA awards for their future revenue. Elon Musk and DOGE are reviewing all NASA contracts despite SpaceX being a recipient and the apparent conflict of interest that causes. LUNR is due to land a spaceship on the moon in the next couple of days, I will review the position then.

JOBY: Joby will need a functioning FAA to get its aircraft approved and will rely on local administrations to support the development of new verti-ports and charging stations. I will be constantly reveiwing JOBY.

Tariffs

The second concern regarding US policy is the arrival of tariffs and a likely trade war.

It affects my view of:

ELVA: despite a new $4 million order, which validates the management's recent announcement of a major customer renewing large-scale orders, ELVA is a Canadian company importing into the US. They will be subject to 25% margins, I do not know precisely how this will play out, but it is not a positive, it will more than likely slow down revenue in 2025 until the New York site is fully operational. They have brought forward the facility's opening date to April this year, but it will only be assembling batteries, not making the cells, and is more of a mitigation move. If ELVA continues to fall I will exit

ARBE: Arbe will release results shortly, but they are in a tight spot. The European customer they hoped to announce will be hit hard by the tariffs as they manufacture in Mexico and import cars to the US. On a second level, they might delay the launch of new electric cars as the US and EU governments extend the timeline for a transition to carbon-free transport. It could mean substantial delays for Arbe, I will review after earnings.

New Trades

The basic plan of riding the wave higher for new technologies is unchanged, however, some technologies look less attractive and I am not interested in riding waves lower. The recent price drops have presented some opportunities to add to existing positions.

D-Wave (QBTS)

I remain convinced that D-Wave is the only quantum hardware company worthy of investment. It’s annealing technology is working today and they have a growing order book with multiple companies moving towards deploying applications on the cloud. They have some important catalysts in the coming weeks. The QBITS conference showcases the technology and always delivers essential information. The earnings call will be an opportunity for the management to try again to explain to the markets why they are different. The competing universal quantum gate computing technology remains a decade or more away. Only Microsoft has a technology with a clear path to the one million qubits a universal gate computer will need.

The wave higher we are hoping to trade is shown below and a turning point may have just arrived.

I will add a midmarket order to open an additional half-size position today. If the market looks like it will be in turmoil following the speech to a joint session yesterday, I will cancel this order. I will update in the comments to this post.

Aris Water

Our only oil and Gas play has been performing well and may benefit from the US push to increase domestic production. I will look to add to Aris if the recent pullback continues, but at the moment, the current price does not satisfy my criteria for an additional position. If it gets below $25, I would become interested, but at the moment, it is too close to all-time highs for me to contemplate adding.

February 2025 Portfolio Performance

It was a poor month. The portfolio fell 11%, the third time in 19 months we have suffered a double-digit loss. The current open trades are in this table along with their performance in February. (snapshot dated March 2nd)

Notably, of the four stocks making a positive return in the month 2 are Chinese and one is European. The only US stock to make ground was ARIS Water, our only oil and gas stock.

Our new energy-oriented US stocks took a large hit. I will continue to rotate out of these stocks in the coming months. The portfolio has been extremely good to us for the last two years, returning 233%, a figure well above the two benchmarks we measure performance against.

World Stock Market Performance

The performance of the significant financial areas is diverging. For more than a decade, the US has accounted for almost 100% of my investments, perhaps this is the time to begin adding other areas. Prior to the US focus, the majority of investments were in Europe and the UK.

I have no opinion on the right or wrongs of the strategic geopolitical shift we are seeing, but as always, my investing will follow the money.

I will not make wholesale changes to the strategy or the portfolio, it will be more of a gradual change. We will still be looking for small emerging technology companies, but the sectors I am considering will change a little, as will the geography.

March Plans

It is not my style to continue buying and holding the same stocks. I rotate in and out of sectors and geographies as the investing market changes, but the fundamental process remains the same: I find undervalued small/mid-cap emerging technology stocks that have a high growth potential and invest until that potential is realized. The ESG sector is not on my radar at the moment; defence, AI, new materials, and Quantum are the areas of focus.

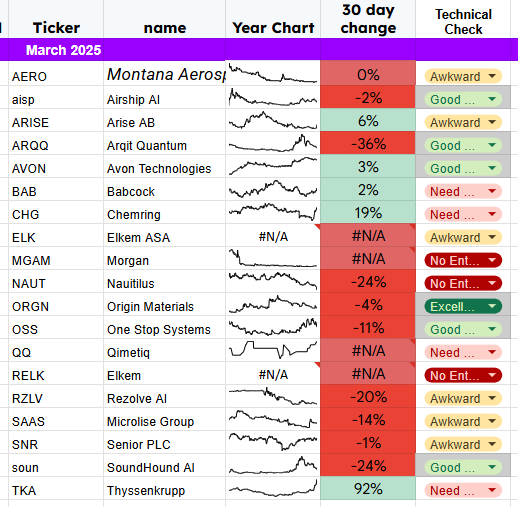

The prospect list for March shows the rotation in action: more European stocks and fewer new energy stocks. The portfolio makeup will naturally change as we identify promising opportunities in these areas.

Remember, I am not a technical trader, so please don't buy the stocks identified as having a good entry point. All this means is that the stock is currently trading lower than it has been. It just dictates the order in which I review them.

All trades will be sent to subscribers before they are taken. Hopefully, we will return to the highly profitable trading that has been a feature for the last two years.

Mid Price order placed on the demonstration account for 32 shares, I will update if and when it fills

Thanks for your research. It is certainly a complicated situation now with tariffs that might actually go away at a moment’s notice.