Pullback Review: Decision Time Approaches

You always need a plan

Without a plan, you will react and make snap decisions under the pressure of mounting losses, inevitably leading to mistakes. Without a plan, we become gamblers and not traders.

We need a plan because markets are pulling back, and it brings doubt and fear. Even though we all know we are investing in risky securities, we tend to overlook the downside risks, despite logically knowing that they exist and that the pain of a $1,000 loss is felt more than the pleasure of a $1,000 win.

We need a plan for the situation we are in.

The Situation

We have a portfolio filled with small-cap, early-stage companies that move farther and faster than the indices. The portfolio has been highly profitable, achieving three consecutive years of triple-digit percentage gains.

Perhaps things are changing, and this week's 5% loss is a sign of changing times. Multiple outlets are predicting a market correction, and if one arrives, our portfolio will suffer, and we can do without that.

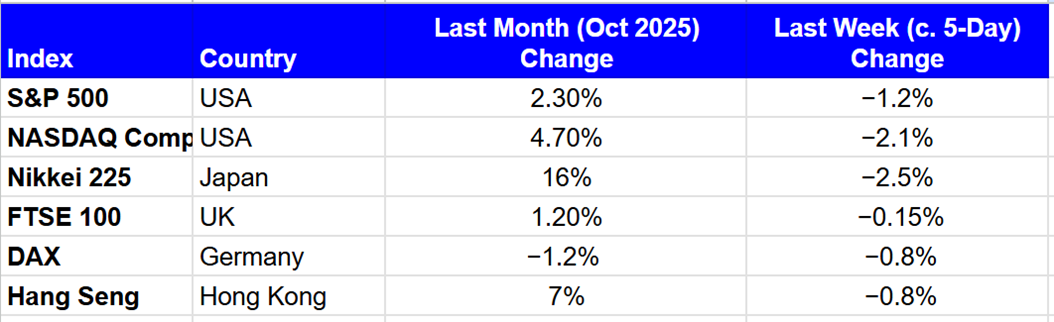

The Asian markets followed the US ones lower overnight with significant falls across all major indices. European stocks have opened mixed, with Germany and France down, but the UK up. Futures are again pointing lower for the US amid volatile trading. The Asian index futures are generally pointing a little higher.

So far, the total moves lower do not indicate a major sell-off, but of course, things could just be starting.

We are a long way from a bear market, and as a result, there is no need for a wholesale move to cash.

If we do see a more sustained move lower, I will once again liquidate our riskier positions first and exit the largest positions, to protect capital and buy again later in the month, or even next month if the drop is prolonged. Drops are typically short and sharp, but even so, as an active manager, I do not want to suffer a large drawdown.

I have been conscientious in managing my position size, ensuring the account maintains a decent cash reserve. This allows us to weather any drawdown and have ample funds to invest later.

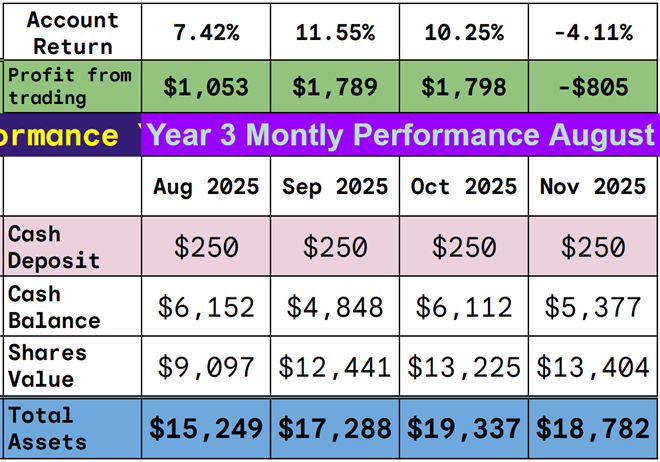

The account balances are as follows (European markets are open, US and Asia closed at time of snapshot)

We have lost approximately half of the profit made last month, and the account is experiencing a drawdown of more than 4%. Some drawdown was almost inevitable after seven consecutive monthly wins. This is not enough to cause any panic, but we do need a plan to avoid any panic, as that will cost us more money than any pullback.

We are in a time of heightened volatility and geopolitical tension, plus the ongoing US government shutdown will begin to impact economic activity. Often, these things become a self-fulfilling prophecy; many pundits predict a pullback, prompting people to sell their shares. It is this selling action that ultimately causes the pullback.

In these situations, you need a plan. What stocks are you going to hold no matter what, which are on the chopping block, and are there any you think it might just be better to offload regardless of the situation?

Disclaimer: I’m not a financial advisor and don’t offer investment advice. This newsletter covers my high-risk trading in small-cap emerging stocks; past performance doesn’t guarantee future returns. Make independent investment decisions based on your own research and risk tolerance; you are solely responsible for outcomes.