Event: Interview with D-Wave

I am preparing to buy QBTS again

On January 10th, I interviewed the CFO and CEO of D-Wave (QBTS) for the second time. I am still hoping they will allow me to record one of these meetings to share with everyone, but they have not agreed to that yet.

The CEO was noticeably more animated and positive about the business prospects than during our first conversation. I would even say he was excited about the revenue he expects to generate in 2025.

The call primarily focused on discussing the changes in the business since our last meeting, which have been quite dramatic. We also discussed the quantum computing industry in general. Here is a summary of our discussion:

D-Wave's Progress

- There was a 500% increase in quarterly bookings, largely due to the sale of an annealing computer, which is the first one they have sold and is expected to generate around $14 million in revenue. A joint announcement with the customer is forthcoming, so we will soon know who purchased it and what they plan to use it for.

- Service Level Agreements (SLAs) are now in place, and companies are paying a premium price when transitioning to a deployed solution rather than a research and development agreement. Pattison and NTT Docomo are two of "many" companies that have moved to the premium SLA.

- The customer count continues to grow. The CEO no longer has a concrete number of customers, as it "is constantly growing," and he no longer has to personally deal with every new customer.

- D-Wave raised additional funds at $4.81 per share, much higher than anticipated, which reduces dilution. They likely need another $175 million, and a new shelf registration has already been established. The CEO no longer believes that cash position will be an issue for the company, as both of them were very concerned about liquidity and the balance sheet during our last conversation, but their concerns have now lessened.

- Both managers clearly believe that 2025 will be a breakout year for revenue.

The Quantum Industry:

The CEO expressed frustration that Jensen Huang, the CEO of Nvidia, lumped all quantum computing companies together in his comments, suggesting it would be 20 years before they are useful. Although his comments were clearly directed at quantum gate computers, the market does not understand the difference between them and quantum annealing, causing all quantum stocks to move together.

We also discussed IONQ's claim regarding the use case for their computers. Like Jensen Huang, the CEO of D-Wave does not believe that any universal quantum gate computer can outperform current classical machines, nor does he believe any use case will or can be found for the current offerings from IONQ, RGTI, and MSFT. In fact, he does not foresee a useful machine becoming available in the next decade. He described the forecast of $1 billion in revenue as unlikely and drew an analogy to a company that recently announced it will move to 5,000 qubits in five years—having made the same announcement five years ago.

The Trading Plan

The sale of a machine, the improving customer count, and the increased margins from the SLAs are all very positive and improve the outlook for D-Wave. If the sale of machines grows it will make a material difference to the company's revenue and drive share prices higher.

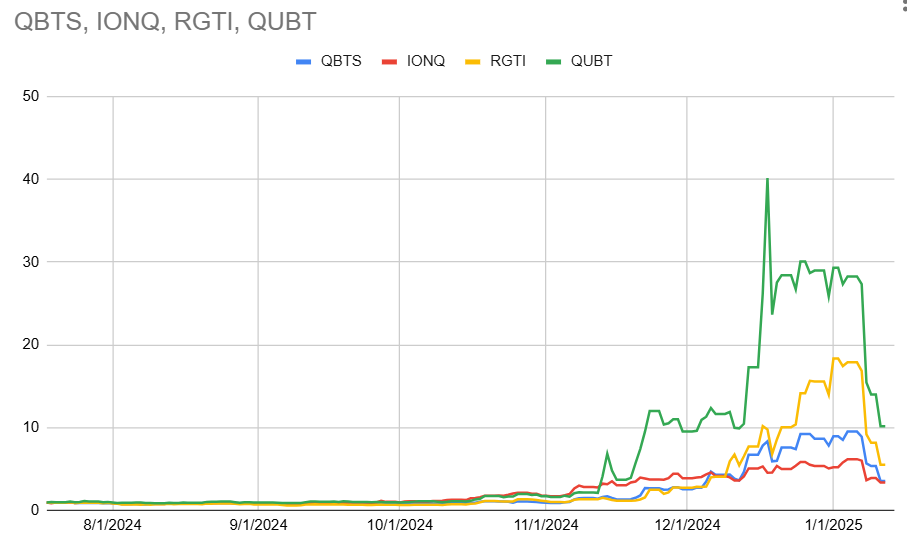

We made a significant profit on our last D-Wave trade, buying at $1.10 and selling at $8.02, making it the most profitable trade of 2024. I want to invest in D-Wave again because I believe it is substantially undervalued at today's price of $4.12. However, there's a concern regarding the movement of all quantum stocks, as they seem to be moving in tandem. The graph below illustrates this trend: they all surged together and are now experiencing a collective decline.

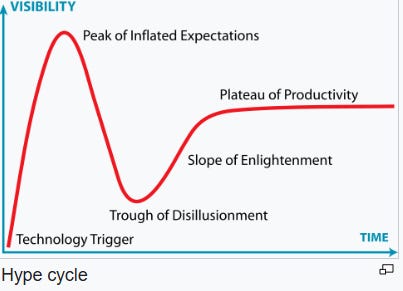

I think the other quantum stocks are virtually worthless, I do not beleive they will be able to develop a useful machine in the next 15 years and will have run out of money well before then. It is a classic case of the Gartner Hype cycle a key part of my trading plan.

The recent growth was due to inflated expectations, which Jensen Huang crushed. All stocks are falling into the trough of disillusionment, but D-Wave will soon be on the slope of enlightenment, and the rest will not.

The market will eventually recognize that D-Wave is not like the rest, but I do not know when. However, the market is moving at pace, so it may be sooner rather than later.

I will watch closely and buy D-Wave when I get an opportunity. As always, I want to minimize risk, so I will look to buy low and sell high. If the correlation between QBTS and the rest breaks or QBTS appears to have found a bottom, I will buy and update you when I do.

I published a strong buy article on Seeking Alpha today that contains a more detailed review of the company and the investment opportunity. When this newsletter moves to a subscription format the article will be published here.

Thanks Stephen, originally bought at 1.14 and sold 2/3 holding at 7.47 - added 50% today at 4.34 and will watch movement before adding more.

Agree this is the only quantum stock worth investing with hopefully long term growth.

Alan