Robot Companies

I am continuing to work through the list of companies on my Robot watch list. I made one investment this week and want to make at least one more before the industry begins to take off. I explained the rationale behind my search for an investment in this earlier post.

I want to find at least one company concentrated on robot security automation and one focused on Humanoid robot development.

My investment strategy focuses on identifying emerging technologies and then investing in high-potential companies that are poised to capitalize on the growth wave as the technology is adopted.

I believe I have identified my Humanoid Robot company and expect to make a purchase next week, but here I examine the leading candidate for investment in the robot security sector. I have decided not to invest yet.

Knightscope (KSCP), Market Leader in Security Robots

Knightscope is a leader in AI security. It has Autonomous Security Robots [ASRs] designed to patrol on random or pre-determined routes and schedules. The ASRs have more than 2.5 million service hours under their belt and have proven to be reliable wheeled machines. KSCP announced its next-generation K7 ASR earlier this year, still a wheeled robot but it looks more like an SUV than a Dalek from the Dr Who series of the 1980s.

In 2022, Knightscope acquired CASE, a manufacturer of blue light emergency phones and wireless emergency communication, collectively known as Emergency Contact Devices [ECD]. A blue light tower is depicted below, it has 24/7 wireless voice connectivity in all weathers. It is often used in parking lots and university campuses where people might feel vulnerable.

ASRs and ECDs are the two hardware product lines of KSCR, but they have significant service income associated with each sale. The company has indicated it intends to grow by acquisition, targeting closely aligned businesses.

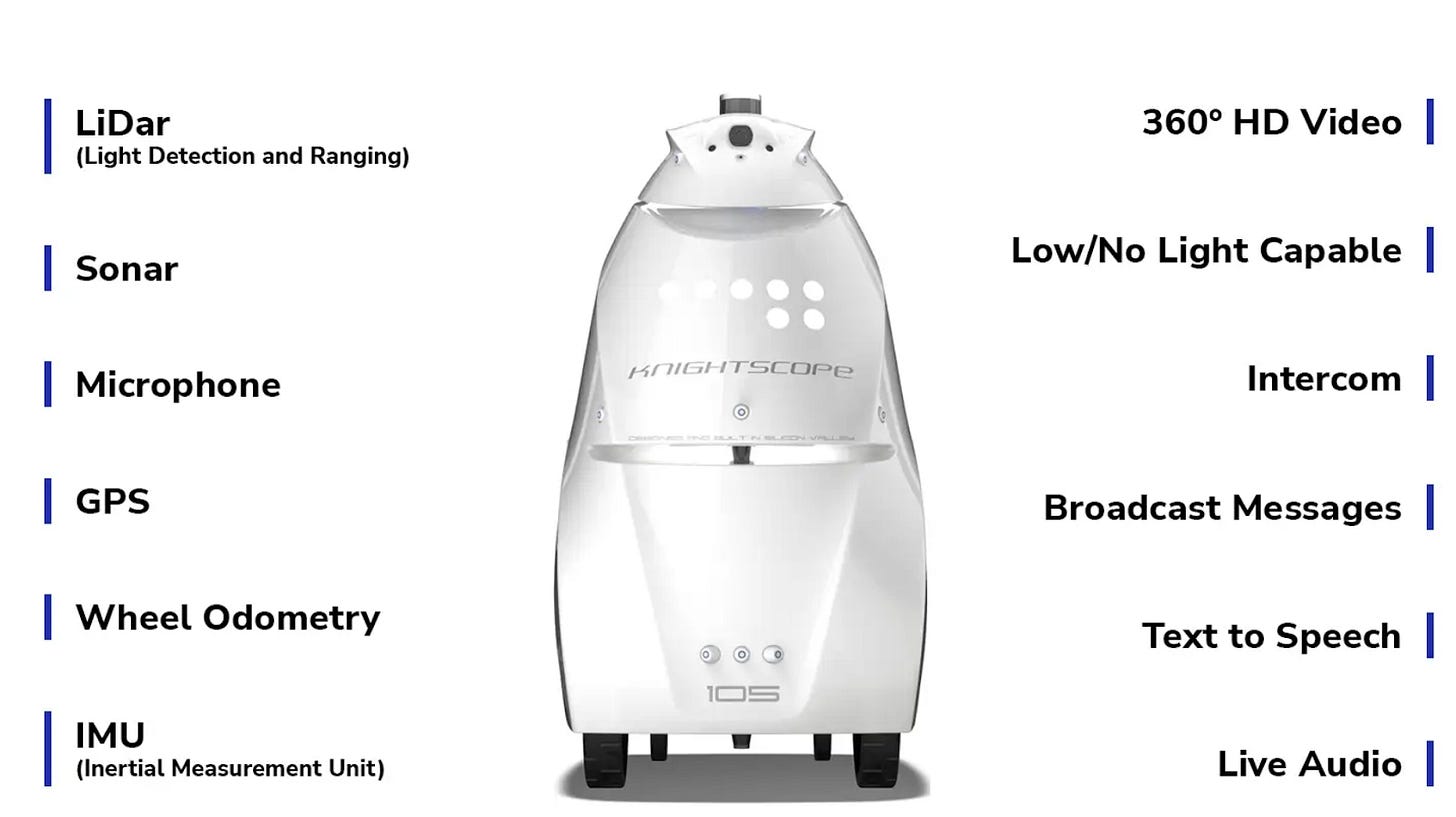

This image, taken from the KSCP website, shows their best-selling K5 robot. It is designed for patrolling car parks, industrial sites, campuses, and factories. (and it looks like a dalek)

They have a first mover advantage in this market, and it is one I have identified as having significant growth potential.

Traction Developing

Q1 revenue was up 25% year on year to $2.9 million, backlog increased from $1.8m to $2.5m.

KSCP was awarded “authority to operate” by the US federal government and is currently the only security robot company with such authority, which opens up a vast potential market.

KSCP has deployed its first federal government robot to the Department of Veterans Affairs and won a phase 1 contract with the US Air Force. They have established a Washington sales office to drive this business.

The business model involves selling these devices as a service, thereby generating ongoing repeat business. They charge between $1 and $11 an hour for an annual subscription, and when you compare that to the cost of having security guards, the business rationale is clear.

KSCP reports that existing clients have extended their contracts for periods ranging from two to eight years. Earlier this month, KSCP announced $1 million of new orders for 535 ECDs and 7 new ASRs. 13 ASR contracts were renewed. These orders included a K5 robot for a real estate customer who also bought a K1, shown below. The K1 sits on top of a tower or on a wall, it is not a robot really more of an intelligent camera.

Target markets include healthcare, gaming, industrial, real estate, education, transportation, and government. It is a market with an enormous total addressable market (TAM), generating many billions of dollars annually.

In April, KSCP announced $1.2 million of orders for 11 ASRs and 70 ECDs. They also announced a new 33,000 sq ft headquarters in Silicon Valley and the start of recruitment for a second shift at its manufacturing site.

One of the contracts in April was 4 K5 robots to a Fortune 25 company. The ECDs all went to university and college campuses.

May saw $2 million in new contracts signed, including 114 ASR renewals, one of which was a 6-year contract with a casino. Long-term contracts were signed in self-storage, hospitality, and health care. A US airport bought 10 K1 blue light towers (that is, a K1 bundled with an ECD tower).

The remainder of this post examines Knightscope's financials and my trading plan for them. This financial work is funded by the paying subscribers and as a result reserved for them