August Review: Surging Returns, new investments imminent

9% return booked eVTOL and Drones next

Summary

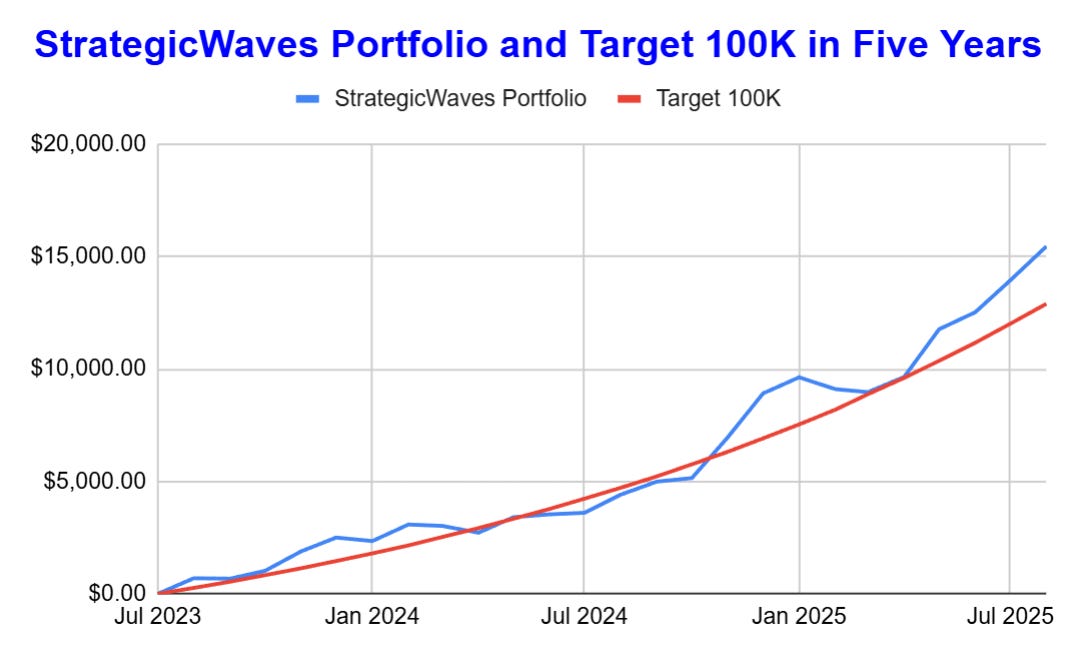

A strong start to the third year of our five-year trading plan, with significant outperformance against market indices in August 2025.

The outlook for September is promising despite ongoing geopolitical and economic factors that could influence future investment strategies. We have identified a new eVTOL trade for the beginning of the month, two further drone investments, and at least one new materials trade.

August Performance

Year 3 of the five-year plan got off to a great start with this first month returning above our target of 5.2%.

The majority of our investments are in small-cap stocks, and the small-cap index staged a big recovery in August, having been in negative territory YTD at the end of July. The recovery of the index bodes well for our portfolio going forward.

Careful stock selection means we have outperformed the small caps index by an order of magnitude; YTD returns are ten times better.

The Project to trade $250 into $100,000 in five years remains above target, as we delivered our fifth consecutive month of profits and ended the month with a balance of over $15,000 for the first time.

The annualized return is now 133.2% and continues to increase as the benefits of compounding take effect. I expect to increase position size again this month, allowing me to take bigger positions and add extra funds to some of our best-performing trades.

Trade Activity

We had a very active month, we were forced to close a couple of trades that resulted in quite big losses. The take a loss trading rule we use, “Look at 30% close at 40%” came into play and led to booking losses in PUMP and the recently opened QSI.

QSI remains on the watch list; PUMP and the other oil and gas companies have been removed from our coverage universe.

Trades Closed in August

We invested in three new companies, acquired one company we had previously owned, and expanded one existing position.

Trades Opened in August

This level of activity is about average for our trading plan.

Once again we bought less than we sold and with the usual $250 investment the cash pile increased by $1,224, we ended the month with a record amount of cash on the account. The total investment stands at $6,250, but we also have $6,152 in cash, as well as over $ 9,000 in stocks.

Portfolio Performance YTD

Our trading is based on company fundamentals, with competitive strategy being the key focus when picking stocks. It is the Strategic part of Strategic Waves.

The Waves part comes from market sentiment, geopolitical concerns, and technicals. These only decide when, but never what to trade.

Market Sentiment

United States: U.S. equities saw their fourth consecutive month of gains, with the S&P 500 up 2%. Mid and small caps outperformed large caps, with the S&P MidCap 400 and S&P SmallCap 600 gaining 3% and 7% respectively, driven by optimism for potential Federal Reserve rate cuts.

Europe: The S&P Europe 350 ended the month with a 1% positive return. The U.K. was a key contributor to gains, following the quarter-point rate cut by the Bank of England. The third rate cut by the BoE reflects growing signs of slowing economic growth and a weakening labor market. France lagged due to an internal government crisis. The Health Care and Consumer Staples sectors led gains, while the Information Technology, Utilities, and Industrials sectors saw minor losses.

Japan: Japanese equities continued their upward momentum, with the S&P Japan 500 rising 5%. Expectations of a Bank of Japan rate hike impacted bonds, with the S&P Japan Bond Index falling 4% YTD, while the Japanese yen strengthened. Volatility, as indicated by the S&P 500's VIX, decreased.

Australia/New Zealand: Both the Reserve Bank of Australia and Reserve Bank of New Zealand cut key rates by 25 bps, boosting fixed income indices. Australian equities, represented by the S&P/ASX 200, increased by 3%, and New Zealand's S&P/NZX 50 Index climbed 1%. Smaller companies in both regions showed significant strength. Volatility continued its downward trend.

China: The Shanghai Composite rose 6.7% in August, closing at a record high, and the small-cap Shenzhen Component index outperformed, delivering a 15% gain. The rise appears to have been fuelled by retail investors moving money into the stock market, margin borrowing hit its highest figure in over a decade. Tech stocks led the charge with the AI chip maker Cambricon posting triple-digit gains. Although broad economic indicators remain weak, the People's Bank of China confirmed its commitment to loose monetary policy for the remainder of 2025 and the continuation of fiscal stimulus.

Geopolitics

The geopolitical situation remains uncertain, the US continues to apply tariffs in what seems like a haphazard manner. Last week, a federal case suggested the President may not have had the authority, under the rules used, to apply them. The case will probably head to the Supreme Court, which has a Republican supermajority and is more likely to side with Mr Trump. However, in the past, the Supreme Court has been critical of presidents overreaching on policies not authorized by Congress.

The upshot is increased uncertainty in global trading relationships, at least until October, which was the date given by the appeals court for the case to be heard by the Supreme Court. It will likely dampen economic activity as foreign companies await the outcome before doing business in the US.

If the Supreme Court sides with the Court of Appeal, it would be, as Mr Trump once said, “a shit show”. What would happen to all of the deals struck since the tariffs began? Will the US have to compensate businesses and return the tariffs already paid? It would severely damage the Trump administration, and one wonders how he would respond.

Russia does not appear serious about peace with Ukraine, and Ukraine seems to be increasingly able to hit targets deep inside Russia. Recent attacks on infrastructure, especially oil and gas, appear designed to destabilize the Russian economy.

The situation in the Middle East gets worse by the hour. Israel continues its policies in Gaza that seem designed to wipe out the Palestinian people, and Europe has decided to begin new sanctions against Iran.

Poor jobs figures in the US and the UK, combined with early indicators of slowing trade, are a concern for all investors.

All of this means we must continue to tread lightly and pursue a conservative trading plan with small position sizes, being prepared to exit if the market turns lower.

September Trade Outlook

After publishing a review of the eVTOL market last week, I have completed my due diligence and will add to our holdings in this area early next week.

The drone/eVTOL sector has been hugely profitable for us. For example, ONDS gained 166% in 27 days last month, and in July, we closed Joby with a 200% profit.

Two more drone investments are approaching, with one new company and one previously held company appearing to be near-term investment opportunities.

Remember to keep position size in check; future investments may not perform as well as previous ones.

Currently, we hold only one position in the new materials sector, acquired in July, which is showing a 27% return. I have been reviewing the market and identified two companies that appear to be suitable investments for September, one of which has already undergone a deep dive.

The Portfolio has good exposure to China, but does not have any stocks on Chinese exchanges. I am exploring the possibility of changing this. Several of our stocks have suggested dual listing in China, and an increasing number of Chinese tech stocks are choosing to list in Hong Kong rather than the US.

Disclaimer: I'm not a financial advisor and don't offer investment advice. This newsletter covers my high-risk trading in small-cap emerging stocks; past performance doesn't guarantee future returns. Make independent investment decisions based on your own research and risk tolerance; you are solely responsible for outcomes.