Adding to ARBE and EH

Portfolio adjustment continues

Further to my earlier newsletter about increasing the size of trades following the closing of the D-Wave and the extra cash on the account. I have decided to add to both ARBE and EH. They both seem significantly undervalued at the moment and now looks like an excellent time to buy. On the demonstration account the trade size has moved from $250 to $350.

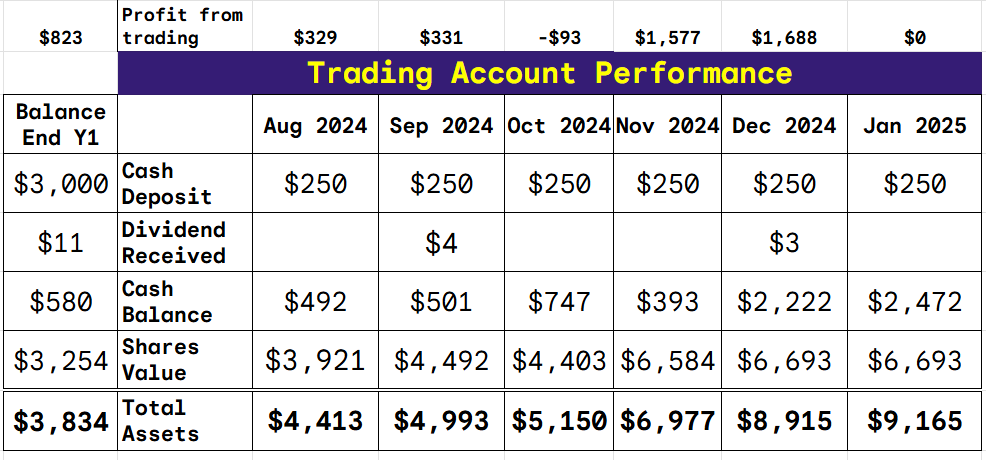

The Current Position of the account is.

ARBE

During my recent interview with the CEO of Arbe, he expressed a strong belief in the company's future, anticipating significant orders in the coming weeks. This positive outlook should lead to a substantial share price appreciation. I have shared a comprehensive analysis on SeekingAlpha, reaffirming a strong buy rating with a price target of $14, instilling confidence in our investment.

I did not buy it earlier because the price action was not suitable. A price surge on the 28th of December implied a fall in price would follow, which has now happened.

As shown in this four-hour chart, I am strategically planning to buy ARBE in the region of $1.70 to $1.85. This approach should help limit the downside to 30% for this trade in the short term, providing a sense of reassurance about our investment.

For Arbe, I am just increasing the position size to $350 (adding $100) which is the new full size.

Ehang

Ehang released provisional results above target, blowing away my forecast. I have not fully adjusted the model yet, but I will do so when I get the final audited accounts. Ehang is shaping up nicely, and the price action allows me to add to this trade. It has made a new high since we bought it and pulled it back, filling the criteria for adding to a trade and I will add a new half-size trade. So I will increase EH by $175

Ehang differs from Arbe; it has already moved to scale production and is generating significant volume. It remains an emerging company in an emerging market but has less risk.

The chart below is a daily one and shows the high in October. Since then, the pullback has aligned with a wave theory pullback, so I am happy to buy.

Other news.

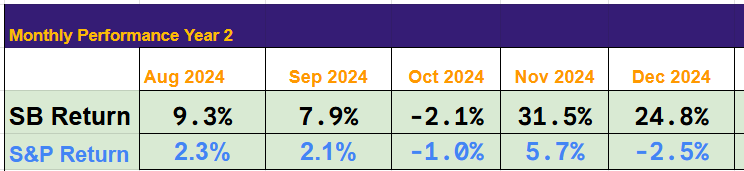

I will make the December wrap-up video in the coming days; it was another excellent month. Returns are shown below.

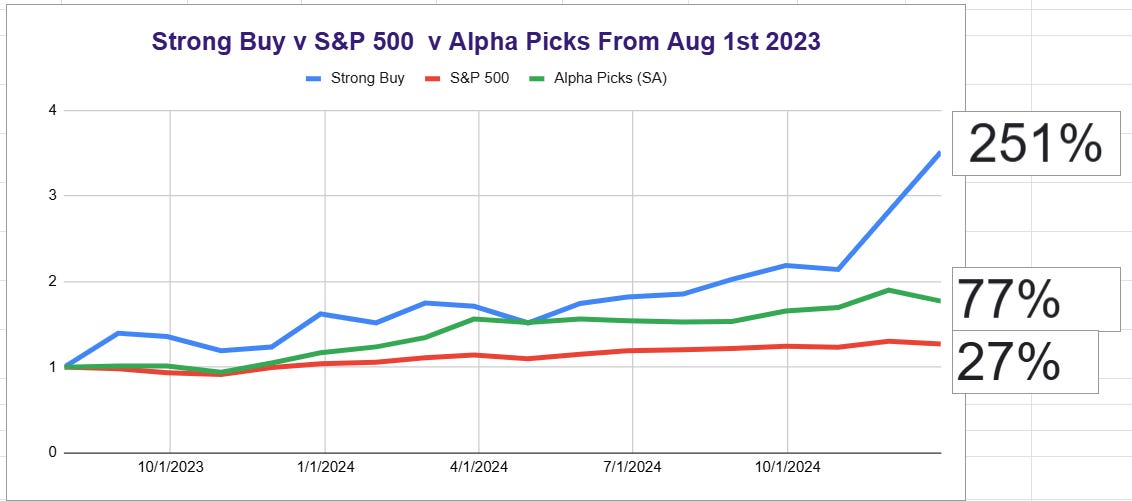

The return for 2024 was 116%, and the return since inception in August 2023 is on the graph.

Thanks to all those who responded to my request for early adopters. Far more people than I expected replied, and I am sorry, but I can't accept the scheme anymore. I expected one or two people to respond, and it was nearly a hundred. I will reply to the first couple who asked to join this month.

I plan to expand the service in August by covering some non-US stocks. I think the portfolio needs a bit of diversification, and I am still working out how I will do this.

The portfolio has been based on my strong buy recommendations articles published on SeekingAlpha, but that will not work for these new regions. I am considering sending them to subscribers who have pledged to the Substack newsletter. It would be a slow launch of the full-service.

In January 2026, the full service will launch when all articles with a strong buy rating go to substack subscribers and are not published on seeking alpha.

An additional ARBE position opened at $2.15, not the price I was hoping for. I was hoping to get in below $2, but as is often the case, the market decides the price, not me. I still believe big news is coming from ARBE this month, and I decided I did not want to miss out.

Ehang has filled at 16.28, Arbe still above the buying area